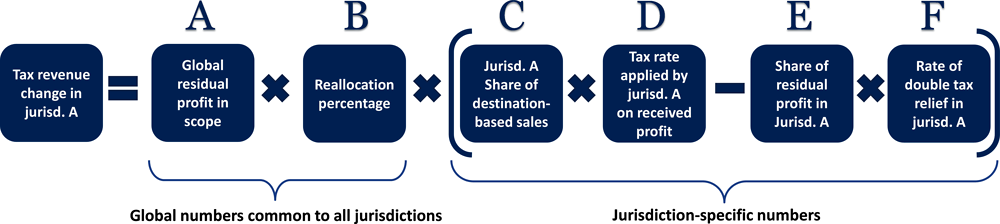

OECD's Pillar One Blueprint: Revenue Sourcing Rules

Blog — Tax Sage Network

G20/OECD Inclusive Framework issues Pillar One Blueprint to Address the Nexus and Profit Allocation Challenges Arising from the Digitalisation of the Economy

2. Tax revenue effects of Pillar One, Tax Challenges Arising from Digitalisation – Economic Impact Assessment : Inclusive Framework on BEPS

Winners and Losers: The OECD's Economic Impact Assessment of Pillar One

New Frontiers of Dispute Settlement in a Pillar One World—Part One

Profit Shifting and the Global Minimum Tax — Penn Wharton Budget Model

Dentons - Summary of the August 2020 draft OECD reports containing blueprints of Pillar 1 and Pillar 2

Delays Ahead: An Update On The OECD's Global Corporate Tax Reform

A Practical Proposal to end Corporate Tax Abuse: METR, a Minimum Effective Tax Rate for Multinationals - Cobham - 2022 - Global Policy - Wiley Online Library

Digital Taxation: Inclusive Framework on Base Erosion & Profit Sh

NishithDesai

Digital Taxation: Inclusive Framework on Base Erosion & Profit Sh